Social Media Backlash Erupts Over Large Restaurant Chains Receiving Millions In Small Business Aid

The $350 billion 'Paycheck Protection Program' has run out of money and some small business owners have been left hanging.

The program, known as "PPP," was created by Congress to target loans at businesses with fewer than 500 employees due to their particular vulnerability to economic slumps—much like the one we're currently experiencing due to the coronavirus pandemic.

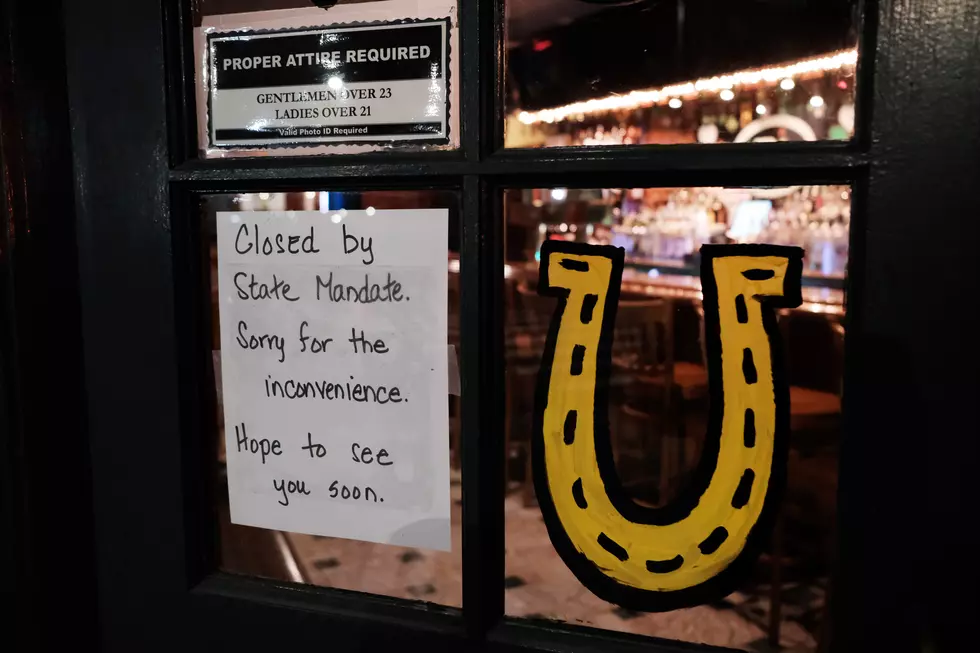

No program is perfect, and much like other programs, PPP has had its fair share of issues as our leaders have scrambled to swiftly get aid to the small businesses and people who need it most. Locally, I've personally watched friends with small businesses juggle between holding onto their employees while also keeping their operations afloat so they have "something to come back to" after the danger of COVID-19 subsides.

Now that the money has "run out" for the time being, reports of large companies raking in tens of millions of dollars have left many on social media upset.

Ruth's Chris is amongst numerous restaurants and companies that have received backlash, and I think it's only fair to point out that the owner of their Steak House chain (Ruth's Hospitality Group, Inc.) either operates or owns 150 restaurants with approximately 5700 employees.

The way they managed to exceed the $10 million cap was by having two of their subsidiaries receive the $10 million max from JPMorgan Chase on April 7 (4 days after the program was introduced) according to the filing. When you divide it evenly that comes to about $130,000 per restaurant or around $3,500 per employee.

FOX Business' Jackie DeAngelis details how this is all legal, but not intended (perhaps?).

I highly doubt it will be evenly distributed that way, but it's only fair to deliver that information for the sake of perspective. But those who are voicing backlash aren't saying that these large companies don't deserve relief more than they are saying that maybe some of these companies are dipping into aid that was meant for "legitimate small businesses"—many of which were left without relief.

Local small business owner Jaci Russo took to social media and offered up numbers to explain why the technicality doesn't make the slap in the face sting any less for the businesses this program was intended for.

Accountable.us shared similar details about how some Americans are up in arms about a situation that some are describing as "insult added to injury."

Big Wall Street-backed restaurant chains that pay their executives super-sized bonuses should not be the first served up SBA loans by this administration. What a slap in the face to the untold thousands of legitimate small businesses that will not survive this crisis, many because they couldn’t get the help they were promised from the president soon enough, if at all.

Hopefully, we will see more money in programs like PPP available for small businesses, big businesses and those they employ a lot sooner than later. Even though it looks like we are looking ahead to "reopening" America, it doesn't mean that we won't feel the residual economic impact of COVID-19 for some time to come.

Share your comments and opinions on this story and be sure to support local businesses of all types when and if you can. They need you more than ever right now.

More From 97.3 The Dawg